Article rédigé par PwC Luxembourg dans le cadre de leur sponsoring de l’ACA Insurance Days 2022.

Insurers and brokers are two very different animals and no one would deny it. But they need each other. They also require at least one common goal (and passion): serving the best interests of their (common) clients.

The massive developments in the field of distribution and consumer protection in the past years gives evidence to this, and the Luxembourg Regulator, Commissariat aux Assurances (“CAA”), has clearly reinforced this message in several recent publications and communications (e.g. circular letters, information notes, events and conferences presentations etc.).

This common objective being set, it first starts with entering (and/or taking over) a relationship with these future policyholders and understanding the full “story”.

Being subject to Anti-Money Laundering and terrorist financing (AML/CFT), as well as Know-Your-Customer (KYC) and Know-Your-Transaction (KYT) obligations, means that insurers and brokers have to collect and review various documents from their clients to avoid the occurrence of money laundering.

The documentation collected on the traditional KYC pillars constitutes important elements to consider as part of the analysis of the AML/KYC and also the tax compliance of the policyholders: structure of the contract, residence of the client and Ultimate Beneficial Ownership (UBO), complexity of the corporate structure used by the client, source of funds and source of wealth…and the list goes on.

This requires a clear understanding of the onboarding and due diligence requirements as a professional of the life insurance sector. Good communication with the clients and/or the other intermediaries and stakeholders involved in the distribution chain is one of the key success factors to receiving and reviewing the appropriate documentation and ensuring full compliance at all times.

As concrete evidence of the above considerations, life insurance companies should currently move forward with their action plan to ensure compliance with the Circular Letter 18/9 issued by CAA. The Circular indeed requires insurers to perform, within a reasonable timeframe, a manual AML/KYC review of the contracts (which may have been initially scored via the “model point” methodology ) and at the latest, before the end of 2024, for the more sensitive contracts and before the end of 2027 for the remaining ones. And this, regardless of the additional time pressure that the “general” periodic review obligations impose. The chase for missing or incomplete information and documents is keeping all insurers busy.

One positive thing is that going forward, insurers and intermediaries will be on some sort of “equal footing” from a practical perspective when it comes to AML/KYC. Indeed, the professionals of the insurance sector acting as intermediaries such as the insurance brokers, the insurance brokerage companies, and independent agents mandated by life insurance companies will need to comply with the requirements of two new circulars that will de facto force a greater collaboration, or at least reinforce the need to organise interactions wisely for a mutual benefit .

Recently issued Circulars 22/2 and 23/3 target insurance intermediaries and respectively describe the best practices and diligences to be performed in the case of a takeover of a client from another intermediary, and the AML/CFT and KYC assessment to be performed at the client’s level through the completion of a structured questionnaire, similar to the one under LC 18/9 for insurers.

This article will first present an overview of the main objectives and requirements of these two new circulars including the attaching points/synergies in the relationships with insurance companies, then analyse in more detail some of the elements that should be part of the AML and due diligence assessment from a tax perspective (a dimension that was somehow overlooked in the past but that has become unavoidable). Throughout the analysis, some best practices to ensure compliance and operational efficiency will be shared by notably considering the interactions with other regulations including tax compliance.

The new Circular 23/3 requires professionals having intermediation activities to perform a structured assessment of their clients through the completion of a new quantitative questionnaire, which, in a nutshell, aims at capturing in a live and dynamic manner the AML/CFT risks related to the contracts.

This AML and CFT assessment will have to be performed for each entry into a business relationship established as from 1 July 2023. It will also require a monitoring and an update of the assessment of the new and pre-existing contracts as part of the periodic review or further to the identification of a movement/transaction or significant change of a client’s contract that would occur after this date.

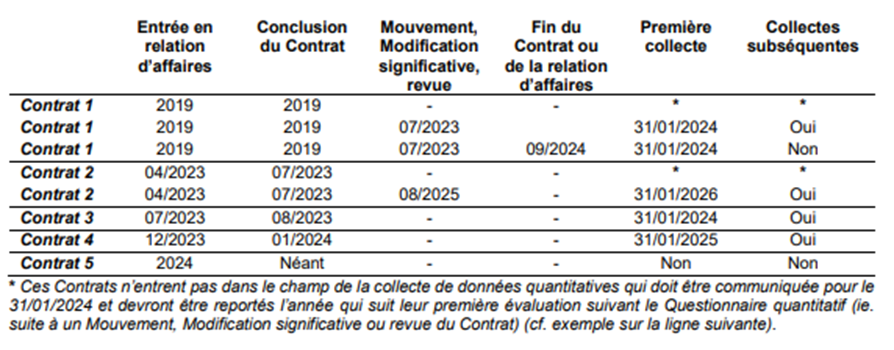

The CAA will require that the professional intermediaries report on an annual basis some information about the entries into the business relationship and about the pre-existing contracts subject to a periodic review. Below is the example contained in the Circular 23/3 for illustrative purposes.

The first report should be submitted by the intermediaries before 31 January 2024 for the civil year 2023 (as from 1 July 2023). The reports for the subsequent years should be submitted before 31 January of the following year.

The operational implications of the above assessment and reporting obligations faced by the insurance intermediaries will have to be reflected in their internal process and procedures and will fall within the scope of the controls performed by the CAA during on-site or remote inspections to ensure the AML/KYC compliance of the professionals concerned.

Notwithstanding the obvious costs to be incurred to adapt systems and processes to these new requirements (especially for smaller players), the positive aspect, and one key incentive to work together and share information in a smoother way, resides in the wide overlap between the LC 23/3 questionnaire and the LC 18/9 one : 38 common questions, 10 reformulated questions and only three replaced/new ones.

So, undoubtedly, this is a new formal obligation for brokers. However some, if not most, of the information may already existor might be retrievable from the ecosystem with reasonable effort. This is of course especially true for intermediaries who already leveraged the LC 18/9 questionnaires in their processes and collaboration with insurers. If not, this is definitely an opportunity to reassess and engage in such discussions.

With respect to the takeover of a client by a life insurance from another intermediary, the Circular 22/2, applicable since 1 January 2023, details the best practices and the requirements to be applied upfront on the AML/CFT assessment of the client. Should there be a clear breach with the documentation provided or missing/inconsistent information on the clients/contracts, the “prospective acquirer” should not proceed further with the contracting process and may need to file a Suspicious Activity Report to the Financial Intelligence Unit in some cases.

As part of the portfolio transfer, the Circular lists some of the information and the documentation that have to be requested. These are clearly similar to the criteria set up in the LC 23/3 questionnaire, so again, leverage is possible and the update of internal processes and procedures should take this into account.

Notably, the prospective intermediary has to particularly focus on the origin of the funds and the situation of the client to ensure the AML/KYC compliance of the client. It should also perform a screening of the other intermediaries involved and assess the quality of procedures in place to ensure its reliability. As a good practice, the intermediaries may prepare a short and structured questionnaire to the attention of the other intermediaries to have sufficient comfort on the quality of the counterpart’s framework, notably on their AML and due diligence compliance. Such assessment could be reused in case of other transfer of portfolio with the same intermediary.

The LC 22/22 also evidences—and this is a crucial point—the importance to not only perform the AML/CFT assessment of the current situation but as well to consider the elements at the initial subscription phase and during the contractual relationship with the previous intermediaries; what we referred above as having “the full story”, which is the foundation of a proper and relevant framework for ongoing due diligence and transaction monitoring. And in most cases, this will trigger the need for a proper remediation exercise which might be a lengthy and complex process.

Indeed, we all know that the remediation projects can be very complex for old contracts, or new contracts with reinvested amounts from previous contracts, where premiums may have been paid in cash or from offshore accounts (including accounts in Luxembourg prior to the transparency period), at a period of time where the requirements for collection of AML/KYC underlying information where less stringent than nowadays. Unfortunately, there are no clear-cut guidelines to find the right balance between the monitoring of the regulatory risk and the pragmatism to ensure a smooth relationship with the various intermediaries. This challenge may increase in case of complex cases that can take the form of partial documentation with respect to the source of wealth, or tax regularisation that occurred years ago.

The remediation exercise is an operational challenge that the professionals of the life insurance sectors should face by adopting a step-by-step approach further to the mapping of their clients based on a cartography of risks. The professional should determine key client information (e.g. date of subscription, amount of the premium, tax residency, suspicious change in the contract etc.…) that should be easily extractable from their system to facilitate the prioritisation of the review of the clients’ files. Indeed, it should enable the allocation of the clients’ files into different categories to notably distinguish the risky files requiring an enhanced AML/KYC review as soon as possible vs. the ones that could be analysed during the periodic review if no particular red flag has been identified.

Overall, the information captured in the context of the application of these new circulars is also very useful for the analysis of tax compliance. For instance, the contracts that have generated a risk score following a positive response notably to the LC 23/3 questionnaire’s items I12 (about special arrangement), I29 (about beneficiary clause to a legal person) and I30 (contract in favor of a natural person subscribed by a legal person) should be subject to a more in-depth analysis. The involvement of a legal person as subscriber or beneficiary of the life insurance contract constitutes a risk of tax non-compliance due to the complexity and opacity it generates, which may be intended to avoid the taxation of income from the structure or to avoid the identification (and reporting if required under CRS) of the Beneficial Owners.

In the following section, we will further elaborate on those pillars and the interactions with the tax compliance of the client.

Since 1 January 2017, the money laundering offense has been extended to aggravated tax fraud (“fraude fiscale aggravée”) and tax evasion (“escroquerie fiscale”).

Brokers and life insurance companies notably have to consider the tax fraud indicators listed in the Circular 17/650 issued by the Commission de Surveillance du Secteur Financier (CSSF) co-signed with the Financial Intelligence Unit (FIU). In addition, a tailor-made list of new indicators on 2 April 2020 has been issued by the ACA considering the specificities of the life insurance industry. The ACA specified that this list is not exhaustive. Even the existence of one or more indicators would not automatically trigger a reporting obligation but would result in a deeper review to assess whether the doubt is justified.

One common misunderstanding is that the professional should only apply a tax fraud analysis for transactions or commercial relationships entered after 1 January 2017. The tax compliance of the funds invested within the contract should be assessed during each KYC review that occurred after that date irrespective of the date of the client relationship. Thus, for instance, tax conformity of a premium paid 20 years ago should still be analysed during the next cycle of AML-KYC review if not already done irrespective of whether no additional payments were made since that date.

One of the most crucial elements that should give a first feeling about the tax compliance of the client for the intermediaries and the life insurance companies is the source of the premium of the policyholder. Those elements are captured by the subsection “La/les primes” of the questionnaire. If the funds come from a bank account located in the same jurisdiction of the tax residency of the policy holder, it should be a positive indicator.

On the contrary, funds coming from high-risk countries from a tax standpoint or bank accounts that are not held by the policyholder would typically increase the risk of being exposed to tax fraud. Brokers and life insurance companies should have sufficient documentation on file to prove that it does not include funds that may not have been declared to the relevant tax authorities in the past, even if reported today in the context of the automatic exchange of information.

In the context of the transfer of a portfolio, the origin of the funds generating the initial subscription of the contract should also be assessed by the new intermediary as part of its obligation described in the Circular 22/2. It is important to obtain sufficient comfort before proceeding further with the new client.

This close scrutiny on the source of the fund is not limited to the insurance industry but also to the banking industry, for instance as evidenced by the Circular issued by The National Belgium Bank (BNB) in June 2021 and the tax fraud indicators contained in the CSSF 17/650. The strengthening of AML/CFT rules in Europe in general leads to greater vigilance by foreign banks and insurers regarding the tax compliance of funds repatriated from abroad and in particular from Luxembourg.

While the origin of wealth also needs to be documented from a tax fraud perspective, there is usually no specific tax risk in connection to this pillar. Indeed, if the origin of wealth is doubtful from a KYC perspective, there is a high probability that proper taxation did not occur.

The tax residencies of the policyholder and the other stakeholders such as the beneficiaries are also an important pillar as part of the AML and tax compliance assessment to be performed. The tax residency should be consistent with the other information on file like the professional activity or the location of the family and any change of tax residency should be explained and the documentation updated.

If an intermediary or a life insurance company identifies the use of fake tax residency by a policyholder, it constitutes an indicator of tax fraud listed under the CSSF Circular 17/650 and has to be reported to the FIU and may lead to an amended CRS report with the correct tax residency by the life insurance company as a Financial Institution to the local tax authorities.

Life insurance companies and intermediaries will always ultimately be responsible for performing their own assessment on the policyholders as well on the other stakeholders as we have notably seen in the transfer of portfolios. This is part of the overall “Conduct” of business.

They should first tackle the risks, and ensure they consider all of them including tax-wise. The AML/KYC assessment to be performed via the completion of the appropriate questionnaires should be seen as a reliable basis to identify atypical elements and red flags that would need to be mitigated with additional documentation or explanation from the client or the other intermediaries. The professionals of the life insurance sectors should then continue to apply a constant risk-based approach built on the key characteristics of the clients that should be defined in their procedures. As we have seen, the origin of the funds and the tax residency are notably important indicators to assessing the overall compliance of the client and to have a global approach by considering the interactions it may have with other regulations that they may face as Financial Institution (under CRS) or as Intermediary (under DAC6).

On a more general stance, and even though we might not yet have reached an AML/KYC ”Guichet unique”, it is clearer than ever that insurers’ and intermediaries’ practices related to AML/KYC assessment and due diligence on their clients should converge, be further reinforced/leveraged and considered holistically.

Indeed, these obligations, even though primarily aimed at preventing reputation and financial risks for the insurance and larger financial services ecosystem, come with a lot of operational, commercial and financial consequences (from system setups and update to clients’ and stakeholders’ experience) in an already highly pressured environment on margins and overall profitability, as well as of heighted clients’ expectations. Therefore, this is something that needs to be embedded, from the beginning, if possible, in the wider projects and initiatives around clients’ experience and journeys, digitalisation and the revamping of front-to-back operational processes undertaken by market players in recent years.

Taking on such initiatives collectively and maximising the chance of the “first time right” for all, will pave the way to making a reality of the widely heard “make an opportunity of (a compliance) constraint!”.

Authors

Robin Bernard, Senior Manager at PwC Luxembourg, Tax Information Reporting

Camille Perez, Director at PwC Luxembourg, Tax Information Reporting

Anthony Dault, Partner at PwC Luxembourg, Insurance Audit and Advisory