In the context of ongoing discussions on the future of the pension system, the Association of Insurance and Reinsurance Companies (ACA) has actively participated in the national consultations launched by the Minister of Health and Social Security. Drawing on its expertise in complementary pension schemes, the ACA has put forward a series of concrete proposals aimed at strengthening the resilience and fairness of Luxembourg’s three-pillar model.

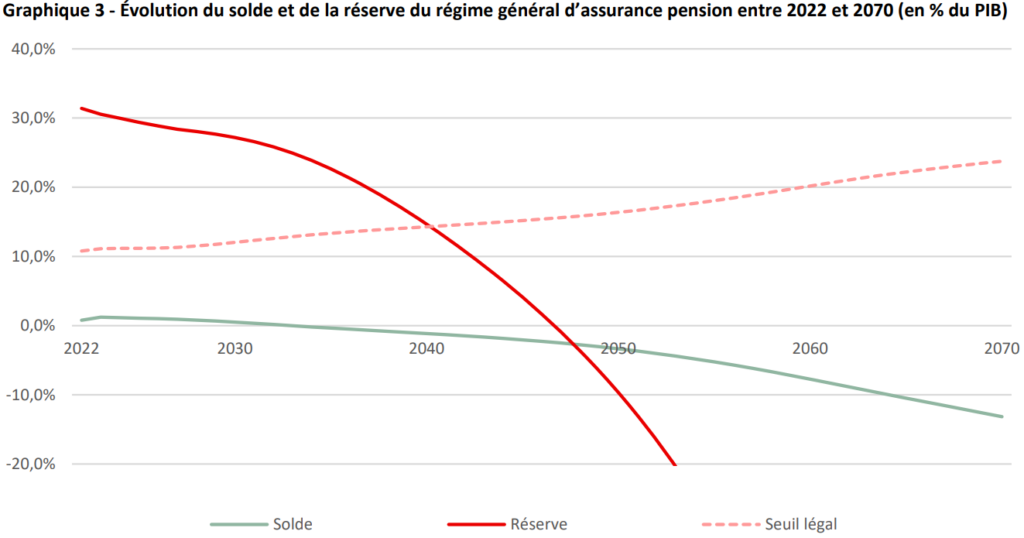

By 2027–2028, pension benefits will exceed contributions, and reserves could be depleted by 2047 if no structural reform is undertaken. ACA fully supports the goal of restoring balance to the public first pillar, while firmly asserting its position: the legal pension must remain the foundation of the system.

ACA advocates for a coherent and balanced approach that complements the public scheme:

Today, only 14% of employees benefit from an occupational pension scheme (2nd pillar).

The 3rd pillar, despite a slight increase in subscriptions, remains underused.

It is essential to preserve these mechanisms. They should be improved by building on existing structures and tools—solid, regulated, and proven advisory networks—while modernising and increasing their flexibility. Confidence in the creation of individual rights is a key factor for success.

The ACA has therefore proposed a series of key measures to revitalise these schemes and restore their full relevance.

The mechanisms exist, and we now have enough perspective to propose meaningful improvements that encourage their use. These proposals preserve the separation between the different contribution systems under sound pension governance (a public 1st pillar financed on a pay-as-you-go basis, and voluntary, individualised 2nd and 3rd pillars funded through capitalisation), all working toward the same societal goals.

Flexibility is becoming essential to allow everyone to plan for retirement in line with their life circumstances. The association reaffirms its commitment to contributing to the debate with technical rigour and a spirit of dialogue.

📢 Discover our full set of proposals in the dedicated dossier: