In the context of ongoing discussions on the future of Luxembourg’s public pension system, ACA participated in the government-led consultations to share its expertise and analysis on the challenges related to the second and third pillars.

Pension reform is rarely popular; however, the situation in Luxembourg must be addressed. During the last legislative elections, the ruling party expressed its intention to examine this issue thoroughly. Shortly after her appointment, the Minister for Health and Social Security launched a broad national consultation on pension reform and, as part of this process, met with ACA to hear its position.

ACA was thus able to present its perspective as a representative of the insurance sector, which is active in the second and third pillars.

On several occasions, and once again during this meeting, ACA clearly reaffirmed its position: to maintain a strong and efficient first public pillar, and not to promote a replacement of the legal pension by the second and third pillars. ACA firmly believes that the legal pension is of primary importance. However, ACA also underlines that, while a reform of the first pillar is essential to ensure its long-term sustainability, the second and third pillars must be part of the reflection. They are levers that can help soften the effects of a potential reform of the legal pension system, while preserving flexibility in terms of retirement amounts and retirement options.

The pension system for working individuals in Luxembourg is based on three pillars.

ACA, as the professional association representing the insurance and reinsurance sector and a member of UEL, participated in and contributed to the work of the “Pensions” working group of the Economic and Social Council (CES). The CES was tasked in 2022 by the previous government with analysing the situation and proposing solutions regarding the long-term financial sustainability of the general pension insurance scheme in Luxembourg.

ACA therefore supports the conclusions of the CES opinion, as presented by UEL, dated 17 July 2024 (regarding the employer contribution).

ACA wishes to highlight several key messages that appear essential to us:

From a factual standpoint, several data-based findings can be drawn from the information available to date in order to assess the sustainability of the legal pension scheme.

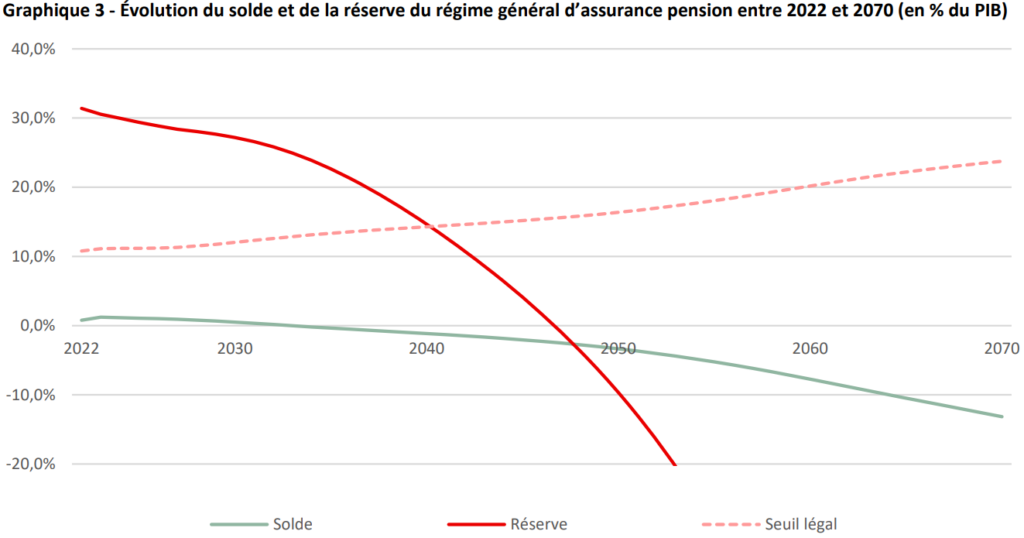

Based on the latest IGSS2 projections, benefits will exceed contributions in the general scheme by 2027/2028, and the reserve will be depleted by 2047.

Starting in 2027–2028, contributions will no longer be sufficient to finance one year of benefits. As a result, the reserve will begin to be drawn upon.

Until now, the growth of the working population has made it possible to finance pensions and build up the reserve. However, as the workforce ages, the number of retirees will increase significantly, and as a result, the draw on the reserve will become increasingly substantial.

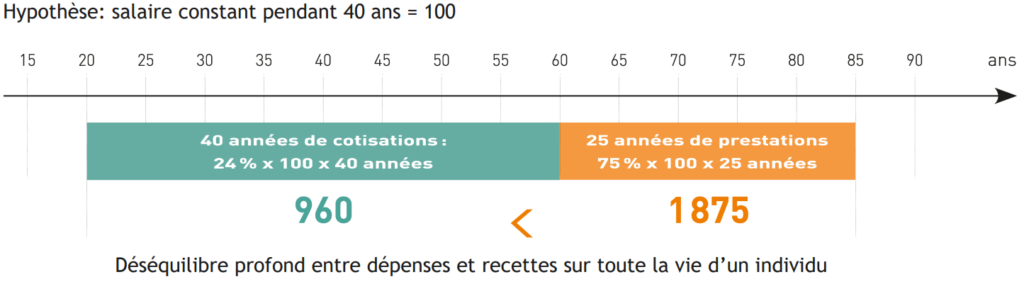

In order to remain sustainable, our legal pension system requires a growth in the working population of approximately 3% per year, meaning a doubling every 24 years. This is due to a significant imbalance between the contributions made by an individual during their working life and the benefits they receive as a retiree.

If we take an extremely simplified3 example with a very optimistic assumption of an individual who starts contributing at age 20 and retires at age 60, the conclusion is as follows:

Thus, on average, each individual:

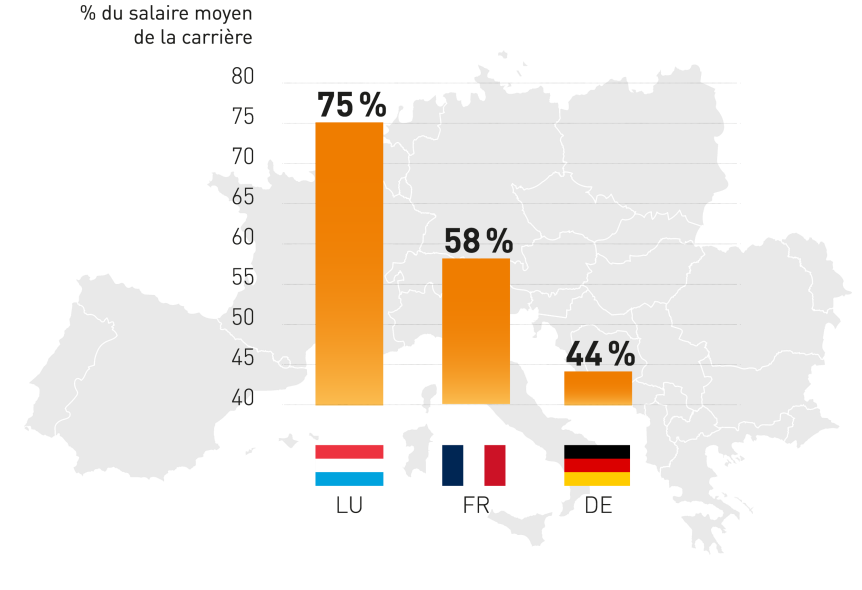

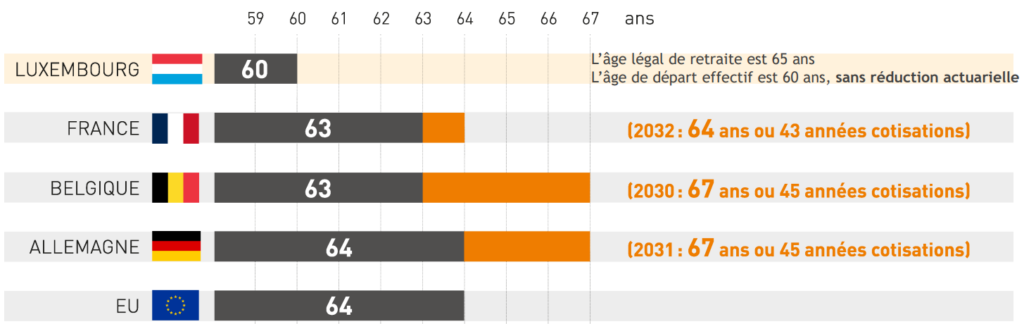

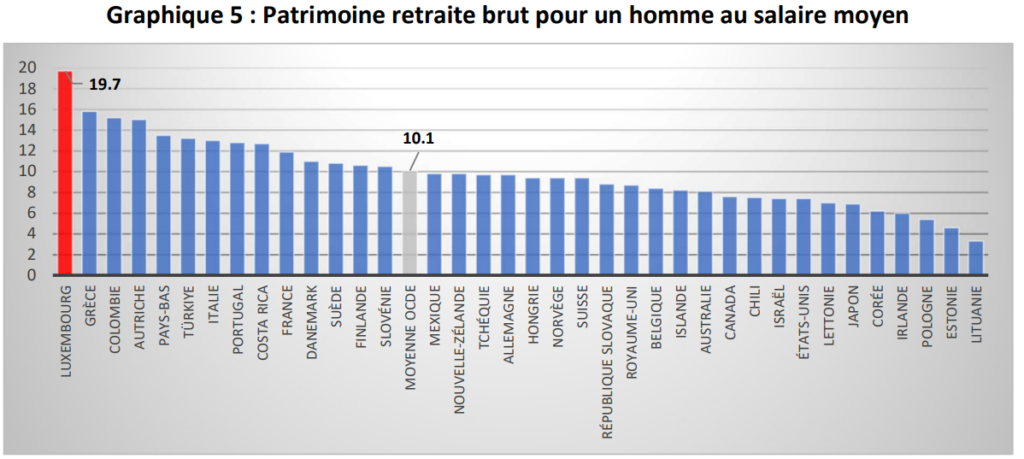

In international comparison, Luxembourg simply offers one of the most generous pension systems among OECD4 countries, both in terms of pension amounts and retirement age (and thus the duration of pension payments).

Source : Pensions at a glance 2023, OECD 2023

Source : 2024 EU Ageing Report

Based on one of the indicators used by the OECD—the retirement wealth (pension capital provided by the general pension scheme for a salary equal to the average wage)—the Luxembourg system ranks at twice the OECD average.

Source : OCDE

We therefore support the implementation of a reform project that would allow the system to achieve a balance between contributions and benefits while restoring intergenerational fairness. In this regard, we also believe it is crucial to involve young contributors in the discussion.

To achieve this, we also believe it is essential to introduce actuarial expertise into the discussions, taking into account all relevant parameters and data. This means considering both contributions and their duration, as well as pension benefits and their duration. In this context, we offer our actuarial expertise to contribute to the discussions on a reform aimed at achieving long-term financial sustainability.

Modern society requires increased flexibility in personal retirement planning. Certain measures, as part of a reform encompassing all pension pillars, could help improve planning flexibility on the one hand, and on the other, mitigate some of the impacts of a reform:

The elements below represent a “toolbox” that would allow each individual to shape a retirement that is more tailored to their needs and aspirations, while moving towards a more balanced system.

To begin this section, it seems relevant to highlight several data-based findings that illustrate the current importance of the second pillar in Luxembourg.

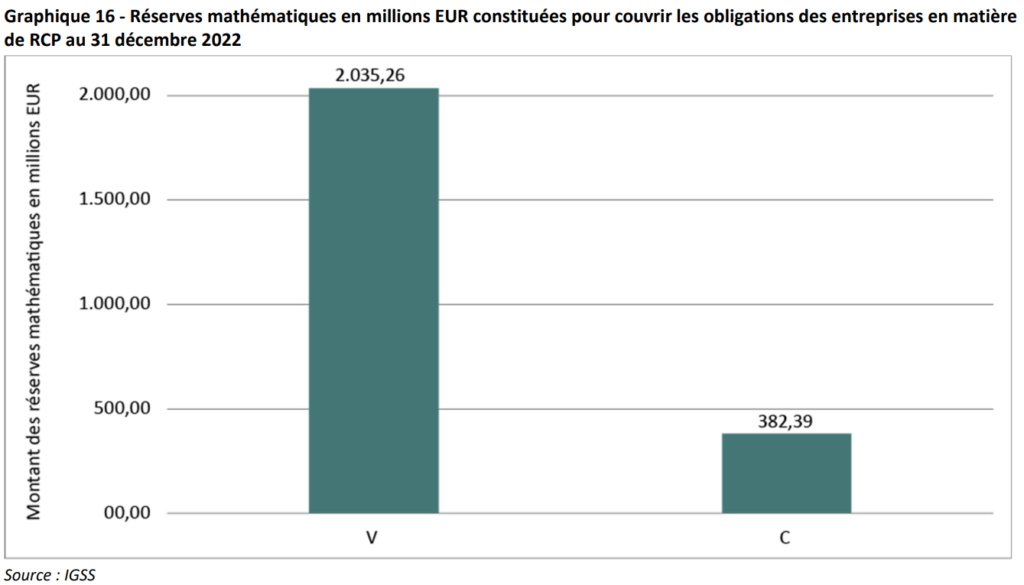

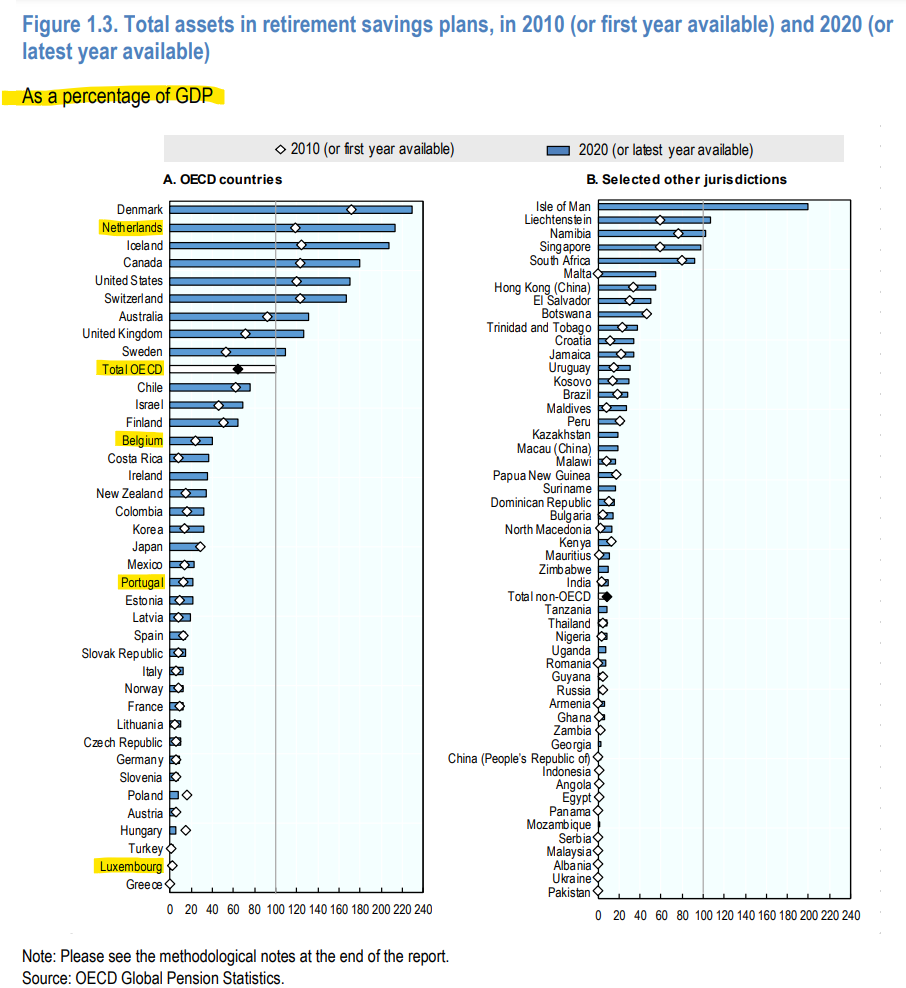

The reserves of the second pillar amounted to €2.4 billion in 2022, representing 2.93% of Luxembourg’s GDP.

When comparing Luxembourg’s figures to those of other OECD countries, it becomes clear that the second pillar is underrepresented in our country.

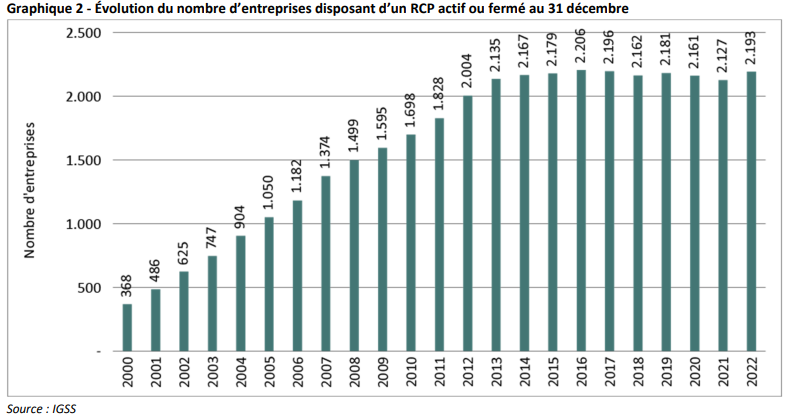

There has been a stagnation in the number of companies offering a complementary pension scheme (RCP) since 20125:

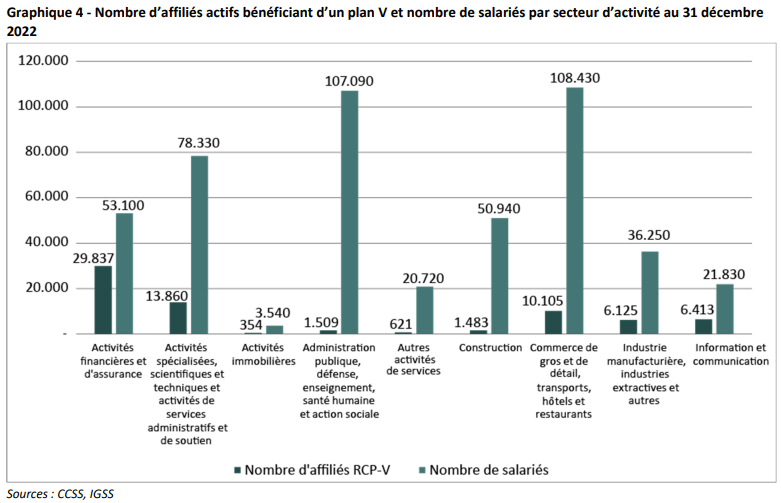

According to data provided by the IGSS for the 2022 financial year, the proportion of employees covered by a complementary pension scheme (RCP) is approximately 14.38% of the workforce in Luxembourg (68,933 active affiliates out of a total of 480,230 employees as of 30.12.2022).

RCPs and their affiliates are predominantly found in the “Financial and insurance activities” sector: 42% of employees affiliated with an RCP work in this sector.

Since 1 January 2019, the RCP law has been open to the self-employed. A total of 1,029 self-employed individuals are affiliated with an RCP, representing coverage of 3.5% of the 29,386 self-employed individuals6. However, it is important to note that this option benefits mainly, if not exclusively, self-employed individuals who are Luxembourg residents, as in practice, international tax uncertainty is a barrier for non-resident Luxembourgers.

With regard to the third pillar, we also observe a low level of representation at the national level.

| Art.111 Bis | 2020 | 2021 | 2022 |

|---|---|---|---|

| Number of contracts | 106 579 | 123 555 | 134 549 |

| Premium income in millions of euros | 177 | 179 | 178 |

| Managed savings in millions of euros | 1 189 | 1 437 | 1 548 |

Source : CAA

We have observed increased interest in this product due to certain changes in the scheme in recent years. In particular, the flexibilisation of exit options (as a lump sum, annually) and the increase in tax ceilings have encouraged subscription through insurance companies.

However, we also observe that the current unindexed maximum deductible premium of €3,200 does not allow for the accumulation of a sufficiently substantial complementary pension to preserve purchasing power.

As an example, the capital accumulated over a 35-year period with an annual premium of €3,200, for a person retiring at the age of 65, could amount to approximately €165,000, corresponding to a monthly annuity of around €6007.

Moreover, the constraints of the current tax framework no longer align with a modern society and do not allow for flexibility in the event of life’s unforeseen circumstances.

Luxembourg faces several major challenges, one of which concerns the financing of pensions due to an ageing population. To address this challenge, various solutions can be considered, including rethinking pension schemes. Encouraging employees to partially build their own retirement must indeed be seen as essential in light of the ongoing debate on the sustainability of the current legal pension system.

As stated by the IDEA Foundation in its 2020 annual opinion, a “strong first pillar is a key feature of an advanced society.” The other two pillars, however, can usefully complement this structure, allowing individuals to better prepare and tailor their retirement periods according to their personal characteristics and aspirations. In this regard, RCPs could become one of the cornerstones of a talent attraction policy.

Such a reflection on the modernisation of the RCP can also be developed by considering the specific features and successes of similar measures existing in other countries. Indeed, more flexible and fiscally attractive pension schemes exist in other countries, particularly in Switzerland, but also in Belgium and the United Kingdom. Swiss and UK schemes allow employees to make voluntary contributions to their pension plans, which benefit from favourable tax treatment under certain conditions (i.e. “salary sacrifice” in the context of RCPs).

Modernising Luxembourg’s pension legislation by drawing inspiration from certain aspects of Swiss or UK legislation could therefore provide a real advantage for the country’s competitiveness and would improve Luxembourg’s ability to attract and retain key individuals.

In addition to being relevant in the context of long-term sustainability of the legal pension scheme in Luxembourg, the need to offer a more competitive RCP from a talent attraction perspective was confirmed during the second employment barometer conducted at the end of 2023 by UEL and the recruitment federation in cooperation with Luxembourg recruitment firms. This survey identified the levers needed to revive the country’s attractiveness, and notably pointed out that “only half of recruitment firms8 use complementary pension schemes to remain competitive.”

Moreover, apart from the opening to self-employed individuals in 2019, there have been no significant developments in the second and third pillars for many years. This has very likely led to the stagnation in the number of RCPs over the past decade, as indicated in the IGSS statistics mentioned earlier in this note.

Finally, the reform of the first pillar introduced in 2012 will result in a reduction of approximately 15% in the pension benefits paid out for retirements starting in 2050. This gradual and still intangible decrease in legal pension benefits, which could worsen under a new reform, makes the need for complementary benefits from the second or third pillars all the more relevant and necessary.

In this perspective, ACA has developed a number of proposals9. The spirit behind these proposals has often been guided by the belief that compromises on pension reform can be reached more easily by giving individuals the flexibility needed to plan their retirement according to their preferences (e.g. some may wish to retire earlier, while others prefer to work longer).

In order to meet these various expectations, the second and third pillars are among the existing tools available that could be used to respond to these needs, provided they are further developed.

In order to reverse the stagnation that has persisted for many years in the area of RCPs, several proposals seem relevant to us and, in our view, would have a revitalising effect on this largely underutilised pillar in Luxembourg, as demonstrated by the OECD’s international comparison:

To learn more, we invite you to discover ACA’s concrete and detailed proposal for the implementation of a second pillar open to all

An increase in the flexibility of the third pillar framework would also help revitalise this pillar, which is likewise underutilised in Luxembourg.

Currently, under the second pillar, each employer may voluntarily decide to set up a complementary pension scheme for the employees of the company. Contributions are paid by the employer, and employees may supplement them with personal contributions. Since 2019, RCPs have also been accessible to self-employed individuals.

As a result, access to a second-pillar complementary pension solution is limited to employees whose employer has chosen to implement an RCP11, and this implementation automatically implies a financial contribution from the employer (employer contributions).

In summary, ACA’s proposal for the implementation of a new type of RCP “open to all” is based on the following key features:

The features of this proposal have been defined based on key principles identified during our reflections:

As part of the public consultation initiated by the Ministry of Health and Social Security in October 2024, several key messages were identified and thematised based on citizen contributions14. During this consultation process, ACA had the opportunity to present a number of proposals15 to Minister Deprez, which, in our view and upon reading the analysis report, clearly echo several concerns expressed by the general public.

We believe that these proposals can, to some extent, form part of the solutions needed to address the issues and consequences of a pension reform that takes into account the outcomes of the public consultation. Such a reform should also rely on the current systems and the existing advisory frameworks and networks, which are robust, regulated, and proven. These could be modernised and made more flexible. Trust in the accumulation of individualised pension rights will be a key factor for success.

Therefore, we advocate for maintaining the separation between the different pension contribution systems as part of sound governance (a public first pillar funded by a pay-as-you-go system – voluntary and individualised private second and third pillars funded by capitalisation), as they are complementary in pursuing common societal goals.

Here are some illustrative examples.

Specifically regarding the capping of pensions, a reform aiming to implement this demand would lead to a reduction in the amount of certain high pensions. Several measures could be introduced to counterbalance the effects of such a reform, for instance, by offering those who would be impacted by it the opportunity to build up sufficient private savings to offset the loss of income from the first pillar. The ACA’s proposals regarding the second and third pillars aim to boost public interest in complementary pension solutions—not to weaken or replace the first pillar, but to offer more flexible and attractive options to those who wish to use them under an improved regulatory framework.

ACA has submitted several proposals aligned with this objective:

The public consultation also revealed a desire for “Recognition of specific life situations.” According to the report: “This category deals with recognising, in terms of pension rights, life periods such as child-rearing, education or caregiving. The goal is to minimise disadvantages and make pension rights more equitable, particularly for women.”

While actions to address this issue largely fall under the scope of statutory pensions, we believe it is also relevant to consider complementary pension tools. These tools are already based on solid and tested frameworks, and with certain modernising and flexibility-enhancing measures, they could become significantly more attractive to the working population.

Thus, in addition to the proposals mentioned above, further ACA proposals could help address specific life situations through complementary pension schemes or insurance products such as the 111bis, as a supplement to statutory pensions:

Lastly, based on the messages extracted from the analysis report, we have identified a public expectation concerning the topic of “Retirement age and transitions.” The report summarises it as follows: “This category includes proposals to adjust the retirement age and to introduce flexible transition models. Special attention is given to physically demanding professions and models that enable gradual reduction in working hours.”

Once again, this reflects a desire for flexibility in retirement models, for instance through a gradual transition to retirement. The various ACA proposals also aim for increased flexibility in complementary retirement models, with the objective of giving greater importance to individual choices made by workers in planning their retirement path.